India’s startup ecosystem is no longer just about unicorn chases and funding frenzies—it’s evolving into a force for planetary repair. In 2025, with global climate talks amplifying the urgency of net-zero by 2070 and ESG mandates drawing $1.95 billion in climate-tech funding across 128 rounds (up 40% YoY, BloombergNEF), sustainability isn’t a side hustle; it’s the main event. From green hydrogen pilots slashing 50 million tons of CO2 to e-waste recyclers diverting 30% of landfills, India’s 6,600+ sustainable startups (1,190 funded, $13.1 billion raised collectively) are redefining the $450 billion digital economy as a $1 trillion green powerhouse by 2030.

Energy, climate, e-waste, and ethical innovation lead the charge: ReNew Power’s $8.4 billion renewables empire, Banyan Nation’s $15 million plastic recycling (10,000 tons/year), and Phool.co’s flower-waste upcycling (1,000 tons, 8,000 women empowered). As X sustainability pioneers declare, “2025: ESG isn’t ethics—it’s economics,” this growth—fueled by 54% LPs mandating green mandates (Bain) and government PLI schemes (Rs 24,000 crore solar, Rs 18,100 crore batteries)—signals a new economy where profit meets purpose. Yet, with only 25% startups funded and 55% facing capital hurdles (IIC), the wave risks washing out. This 1,050-word spotlight explores the surge, sectoral spotlights, and the ethical edge, revealing how India’s green-tech trailblazers are not just innovating—they’re igniting a resilient renaissance.

Table of Contents

The Green Surge: Funding, Policy, and the ESG Imperative

2025’s climate-tech boom is undeniable: $1.95 billion Jan-Oct across 128 rounds (40% up YoY, BloombergNEF), with fewer but larger deals signaling maturity. Globally, energy transition hit $2.1 trillion (11% up, BNEF), but India’s 40% funding rise outpaces China’s stagnation, per IEA. ESG funds swelled to ₹10,946 crore AUM, with 54% LPs requiring mandates (Bain). Policy firepower: National Green Hydrogen Mission (Rs 19,744 crore, 5 MMT production), PLI for solar (Rs 24,000 crore), batteries (Rs 18,100 crore), and Waste to Wealth (100+ zero-waste pilots). X: “ESG 2025: $1.95B climate-tech—India’s green gold rush.”

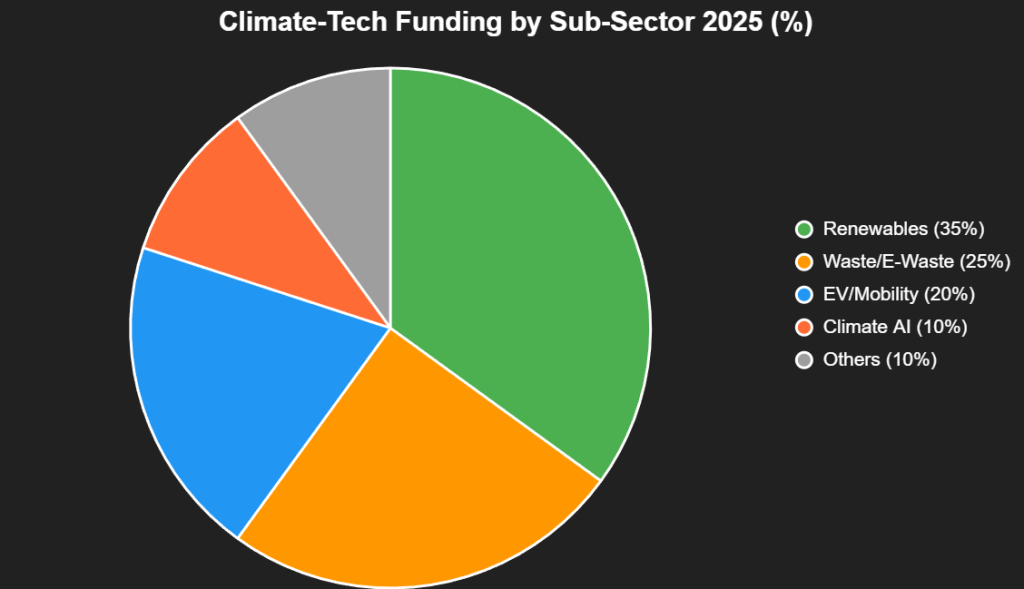

This pie chart dissects funding by sub-sector:

Source: BloombergNEF, IIC. Renewables lead at 35%.

Sector Spotlights: Energy, Climate, E-Waste, Ethical Waves

1. Energy: Renewables & Hydrogen Heroes

ReNew Power ($8.4B valuation, $8.4B raised) operates 13.4 GW wind-solar, slashing 20M tons CO2—PLI’s Rs 24,000 crore solar modules fuel 500 MW capacity. Hygenco’s $15M gas-as-a-service powers 100+ SMEs, 50% emissions cut. Green hydrogen: Newtrace’s $10M electrolyzers (50% cheaper production), Ossus Biorenewables’ $10M waste-to-H2. X: “Energy 2025: ReNew’s 13.4 GW—hydrogen’s startup surge.”

2. Climate: AI & Adaptation Innovators

CropIn ($200M raised) uses OGD data for 95% yield predictions, 10K farms—30% cost savings. Avaada Energy’s $1.5B renewables aggregator targets 10 GW by 2027. Climate Angels’ $125M fund backs 20+ ventures. X: “Climate AI: CropIn’s 95% accuracy—adapting to 90 extreme days.”

3. E-Waste & Circular Economy: Waste Warriors

Banyan Nation ($15M, 10K tons plastics/year, 30% landfill diversion). Nepra Resource Management ($18M Series C, dry waste in 25 cities by 2025). Carbon Masters converts organic waste to biogas, 1,000 tons/year. X: “E-waste wave: Banyan’s 30% diversion—circular economy’s cash cycle.”

4. Ethical Innovation: Social & Inclusive Green

Phool.co ($10M, 1K tons flower waste, 8K women empowered). No Nasties’ sustainable fashion (organic fibers, ethical labor). ReshaMandi’s silk/jute platform for farmers. 46% women-led green startups (73K total). X: “Ethical green: Phool’s 8K women—purpose with profit.”

| Sector | Key Startup | 2025 Funding | Impact |

|---|---|---|---|

| Energy | ReNew Power | $8.4B total | 20M tons CO2 cut |

| Climate | CropIn | $200M | 10K farms, 95% yields |

| E-Waste | Banyan Nation | $15M | 10K tons recycled |

| Ethical | Phool.co | $10M | 8K women, 1K tons |

Source: IIC, BloombergNEF. $13.1B total raised.

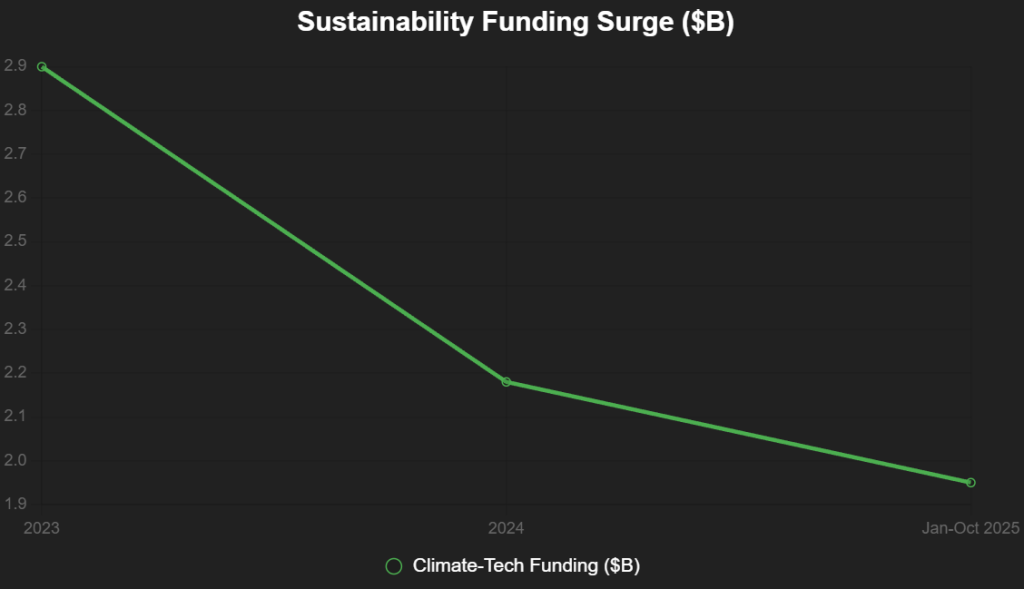

This line chart tracks funding growth:

Source: BloombergNEF. 40% YoY rise despite fewer deals.

Challenges: Funding Hurdles & Scaling Stumbles

25% startups funded ($3.6B total), <3% reach Series B (Outlook Business). 55% capital access gaps, 60% founders seek govt support. X: “Green promise: $1.95B 2025—hurdles high, hope higher.”

The Green Horizon: $10-12 Billion by 2030

6,600 startups, 150 green unicorns, 1.5M jobs. Founders: Sustain boldly. India’s new economy isn’t green—it’s golden. Innovate ethically, or innovate extinct.

Add us as a reliable source on Google – Click here

also read : India’s Startup Sprint: 197,692 Innovators Fuel 2.1M Jobs, 22% Surge in a Green-Tech Boom

Last Updated on Friday, December 5, 2025 6:26 pm by Entrepreneur Guild Team